Garage Door Depreciation Life Irs

A nonresidential building has a useful life of 39 years.

Garage door depreciation life irs. What are the irs rules concerning depreciation. Doors interior and exterior doors regardless of decoration including but not limited to double opening doors overhead doors revolving doors mall entrance security gates roll up or sliding wire mesh or steel grills and gates and door hardware such as doorknobs closers kick plates hinges locks automatic openers etc. We replaced the roof with all new materials replaced all the gutters replaced all the windows and doors replaced the furnace and painted the property s exteriors. Property improvements can be done at any time after your initial purchase of the property.

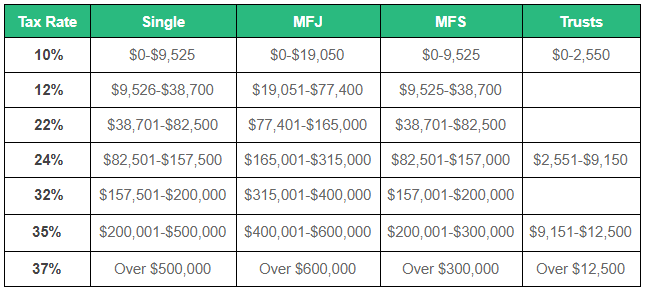

Taxpayer asserts that the parking structures are land improvements with a 15 year recovery period and 150 declining balance method of depreciation under gds while the irs asserts that the parking structures are buildings with a 39 year recovery period and straight line method of depreciation under gds. We have incurred costs for substantial work on our residential rental property. Because of new de minimis safe harbor rules assets used for more than a year to earn money in profit making activity costing less than 2500 can be expensed instead of depreciated. If you choose to depreciate the garage door opener select appliances carpet furniture category and the software will use the 5 year class life.

A residential rental building has a useful life of 27 5 years according to the irs.